Getting The G. Halsey Wickser, Loan Agent To Work

Table of ContentsThe Best Guide To G. Halsey Wickser, Loan AgentUnknown Facts About G. Halsey Wickser, Loan AgentThe 5-Minute Rule for G. Halsey Wickser, Loan AgentEverything about G. Halsey Wickser, Loan AgentThe Of G. Halsey Wickser, Loan Agent

They might bill lending origination fees, upfront fees, financing administration fees, a yield-spread premium, or just a broker commission. When dealing with a mortgage broker, you need to clarify what their cost framework is early on at the same time so there are no shocks on shutting day. A home mortgage broker generally only earns money when a car loan closes and the funds are launched.The bulk of brokers do not cost debtors anything up front and they are usually safe. You should make use of a home loan broker if you want to locate access to home mortgage that aren't conveniently marketed to you. If you do not have remarkable credit scores, if you have an unique loaning circumstance like possessing your own business, or if you simply aren't seeing home loans that will help you, then a broker might be able to get you accessibility to financings that will be advantageous to you.

Home mortgage brokers may additionally be able to assist lending seekers get a reduced rate of interest than a lot of the industrial loans offer. Do you require a mortgage broker? Well, dealing with one can conserve a borrower time and initiative throughout the application procedure, and potentially a great deal of cash over the life of the finance.

G. Halsey Wickser, Loan Agent for Dummies

A specialist home mortgage broker comes from, bargains, and processes residential and business mortgage in support of the customer. Below is a 6 point guide to the solutions you ought to be provided and the assumptions you need to have of a competent home loan broker: A mortgage broker offers a broad variety of home mortgage finances from a number of different loan providers.

A mortgage broker represents your interests instead than the rate of interests of a financing organization. They ought to act not just as your representative, but as a knowledgeable specialist and trouble solver - Mortgage Broker Glendale CA. With access to a wide array of mortgage items, a broker is able to provide you the biggest worth in terms of passion rate, settlement quantities, and lending products

Lots of scenarios demand greater than the easy use a three decades, 15 year, or flexible price home mortgage (ARM), so ingenious mortgage strategies and sophisticated options are the benefit of collaborating with a seasoned mortgage broker. A home mortgage broker navigates the customer with any situation, handling the procedure and smoothing any type of bumps in the roadway in the process.

Little Known Questions About G. Halsey Wickser, Loan Agent.

Borrowers who locate they require larger lendings than their financial institution will approve also take advantage of a broker's knowledge and capability to effectively get financing. With a mortgage broker, you only need one application, as opposed to completing types for every specific lender. Your home mortgage broker can give an official contrast of any financings advised, directing you to the info that properly represents price distinctions, with existing rates, factors, and closing costs for each loan reflected.

A reputable home mortgage broker will reveal just how they are spent for their solutions, along with information the overall costs for the funding. Personalized solution is the setting apart aspect when picking a home loan broker. You need to expect your home mortgage broker to help smooth the way, be offered to you, and encourage you throughout the closing process.

The trip from dreaming concerning a brand-new home to in fact possessing one might be full of difficulties for you, specifically when it (https://www.ourbizdirectory.com/finance/g-halsey-wickser-loan-agent) involves protecting a mortgage in Dubai. If you have actually been thinking that going directly to your financial institution is the ideal route, you may be losing out on a less complicated and potentially much more helpful alternative: collaborating with a home mortgages broker.

The smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Discussing

One of the considerable advantages of making use of a home mortgage professional is the specialist financial guidance and necessary insurance policy advice you obtain. Home mortgage specialists have a deep understanding of the numerous monetary products and can help you select the right mortgage insurance policy. They make certain that you are properly covered and offer recommendations tailored to your financial circumstance and long-term objectives.

This process can be challenging and time-consuming for you. A mortgage brokers take this problem off your shoulders by managing all the documents and application processes. They know exactly what is called for and make sure that whatever is finished precisely and in a timely manner, decreasing the risk of hold-ups and errors. Time is money, and a home mortgage financing broker can conserve you both.

This means you have a much better possibility of locating a home loan in the UAE that completely matches your demands, including specialized products that could not be available through conventional banking channels. Browsing the home mortgage market can be complex, especially with the myriad of products available. An offers professional assistance, aiding you comprehend the pros and disadvantages of each choice.

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

This expert recommendations is important in safeguarding a home loan that straightens with your monetary objectives. Mortgage consultants have established partnerships with numerous lending institutions, providing them substantial working out power.

Barret Oliver Then & Now!

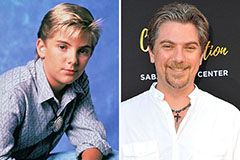

Barret Oliver Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Jeremy Miller Then & Now!

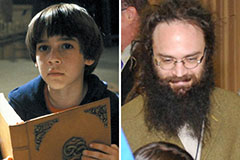

Jeremy Miller Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Lynda Carter Then & Now!

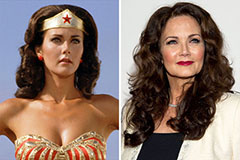

Lynda Carter Then & Now!